How Does a Reverse Mortgage Work?

What is a reverse mortgage?A reverse mortgage allows homeowners of a certain age, 62 years and older, to borrow from their home’s equity without having to make monthly mortgage payments. As the borrower the homeowner may then choose to take funds in a lump sum, line...

Carlie Clemens Mortgage Loan Officer NMLS 1733060

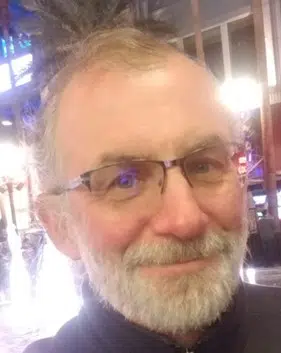

David H. Steinbrugge

Reviews

Trustindex verifies that the original source of the review is Google. David Steinbrugge is a one-of-a-kind professional, with decades of experience in mortgage lending. Having worked with him, as an appraiser, since the 1990's, I know he honestly delivers his financial products with the utmost fiduciary care, and personal service.Trustindex verifies that the original source of the review is Google. I have had the pleasure of working with Stonebridge Mortgage Group over the last fifteen years for my home loans and have been so happy with the experience I've referred friends and family. I've always been very grateful for their guidance through every step, including answering all of my questions and ensuring I felt confident in my decisions. They even helped me understand the lender's requests and of course helped me get the best fast rate!Trustindex verifies that the original source of the review is Google. This was the smoothest loan process I've ever had. Carlie and Joseph made sure all of my questions were answered, and they were ready to close two weeks ahead of schedule!Trustindex verifies that the original source of the review is Google. David does a amazing job counseling his borrowers through the whole process. He has closed many loans with me over the years and I find him to give great attention to detail and he is great with his communication. If you are looking for someone to help you buy a home or looking to refinance I highly recommend David Steinbrugge.Trustindex verifies that the original source of the review is Google. I can’t think David enough for his help in buying my condo. It was a very stressful time in my life and he made the process easy. He’s professional, knowledgeable, quick to respond, and so very helpful. Thank you again for making this purchase so easy and for helping me to close early! I will reach out to David for his assistance again in the future!Trustindex verifies that the original source of the review is Google. We just closed today on our refinance through Stonebridge Mortgage. David made the process so easy! I filled out our application online and then communicated by email, electronically signed docs as needed, and before I knew it, we were signing at the escrow company! The only challenges were that of the underwriter, requiring employment verification for my current employer and the prior two, and clarification on recent credit transactions. That wasn't Stonebridge's fault - just new lending requirements. David was extremely responsive and professional and we felt confident in his support, knowing we'd get the best loan we could. Thanks, David and team!Trustindex verifies that the original source of the review is Google. I couldn't be more pleased with my experience with Lee Gomez and his team at Stonebridge Mortgage. We did a Refiance of our home near Monterey Ca with them. From the time we began the process to the end he was super knowledgeable and constantly in touch. There was never a time that he wasn't responsive to our questions. He went the extra mile and got us a better rate and a few extra dollars to do more construction. If we have a future interest rate drop, we intend to call 📞 Lee Gomez and his team!Trustindex verifies that the original source of the review is Google. We have chosen Stonebridge a couple times now, and they are always a pleasure to do business with.Trustindex verifies that the original source of the review is Google. Refinancing our home through Stonebridge Mortgage was a great experience. They locked in a great rate, laid out each step along the way, and provided regular updates throughout the process. It couldn't have gone more smoothly and now we are saving $300/mo! Thank you Stonebridge Mortgage!Trustindex verifies that the original source of the review is Google. David is very easy to work with and makes the entire process very simple. I have used Stonebridge for initial purchase and refinance and it only gets better. Get the straight answer quickly from StonebridgeLoad more